An open-ended equity scheme following manufacturing theme

NFO Period – April 26, 2024 – May 10, 2024

HDFC Asset Management Co. Ltd., the investment manager to HDFC Mutual Fund (HDFC MF) announces the launch of HDFC Manufacturing Fund. This open-ended equity scheme aims to unlock the potential of India's manufacturing sector by investing predominantly in equity and equity-related securities of companies engaged in manufacturing activities. The NFO for HDFC Manufacturing Fund commences on April 26, 2024, and concludes on May 10, 2024.

India's manufacturing sector stands at the cusp of an Amrit Kaal, a golden era, fuelled by various factors such as growing consumption, investments, and exports, coupled with changing geopolitical dynamics and the government's push for self-reliance through reforms and incentives. The fund seeks to capitalize on these tailwinds, offering investors an opportunity to participate in the country's transformation into a global manufacturing powerhouse.

HDFC Manufacturing Fund’s investment strategy emphasizes on a core portfolio comprising at least 80% investment in stocks representing diverse sectors under the Manufacturing theme. The fund's flexible approach allows for investments across market capitalization, offering investors an exposure to a wide range of opportunities within the manufacturing landscape.

Mr. Navneet Munot, Managing Director and Chief Executive Officer of HDFC Asset Management Company Limited, said, “We are delighted to introduce the HDFC Manufacturing Fund to our investors. At HDFC Mutual Fund, we have always endeavoured to be a one-stop solution for varied financial goals and have delivered a wide array of opportunities through our diverse product bouquet. HDFC Manufacturing Fund becomes the latest addition to our diverse set of offerings.”

The scheme will be managed by Mr. Rakesh Sethia, Fund Manager of HDFC Manufacturing Fund, with over 19 years of experience in equity research said, “Our investment style revolves around rigorous bottom-up research aimed at identifying companies with a compelling long-term growth story. We seek to construct a portfolio that balances established industry leaders with emerging disruptors, ensuring a diverse mix of opportunities within the manufacturing sector.”

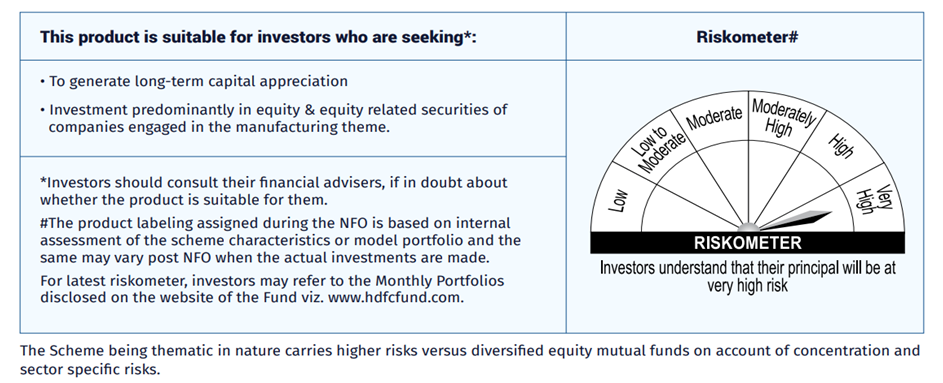

Investors can expect the fund to target both established industry leaders and emerging disruptors, aiming at a balanced portfolio with the potential for sustained growth. The fund’s investment objective is to provide long-term capital appreciation by identifying companies poised to benefit fromIndia’smanufacturingresurgence.